Smart Money

Smart Business

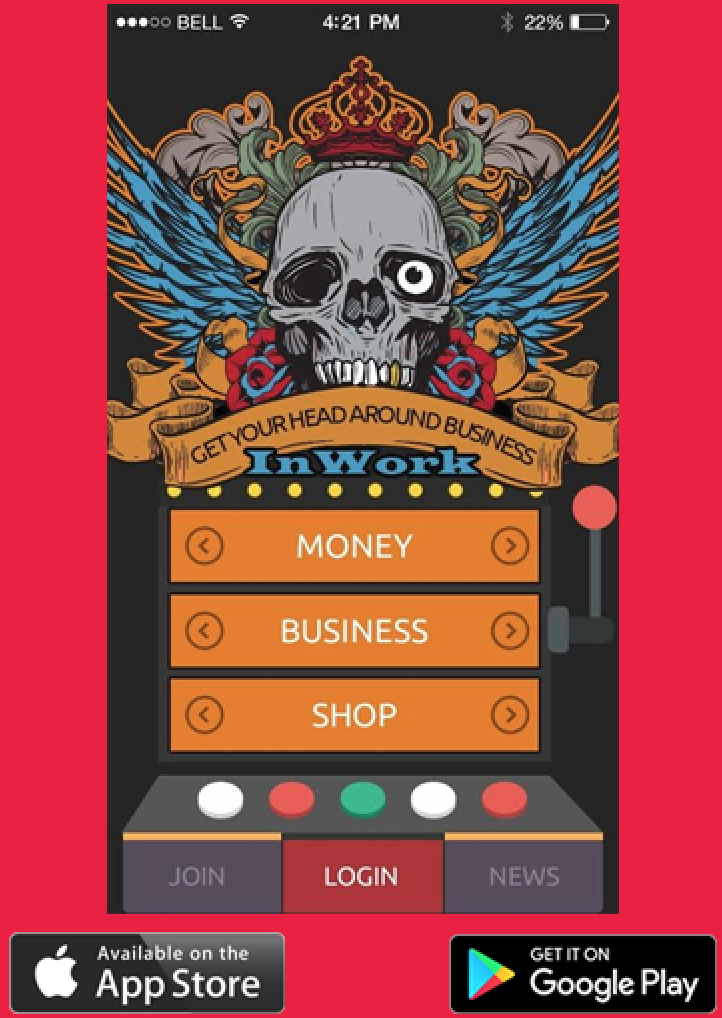

Money

2 Billion people need more information to help them access banking systems and benefit from financial products.

In America 76% of people survive paycheck to paycheck and many have less than US$500 saved to meet financial shock of unemployment, or unexpected expense. 9.6 Million UK households have zero savings.

Teaching Money Skills to Students improves their financial capability, but Workers also need Financial Information at the point of action, when they are faced with making important financial decisions about Loans, Savings or Pensions.

InWork seeks to deliver financial education to help both Students and Workers understand how best to manage their money and benefit from using Financial Products.

…More

Download

InWork App

Pensions

Currently 43 Million Americans are aged over 65. Within next 30 years, by 2050 the number of Americans aged over 65 is forecast to double to 84 Million.

This is a Demographic Time Bomb and governments in many countries do not have the resources to pay Pension costs.

Many small US Employers pay a contribution of just 3% of Annual Salary into a Pension and some large US Employers pay a 10% of Annual Salary,

but pensions experts say a contribution of 15% is typically required.

US citizens can take out a 401K financial plan to make their own additional contributions to their pension.

InWork seeks to provide information about Pension products and how to convert a Pension in to an Annuity, to secure you lifetime retirement income.

…More

Financial

InWork explains basic features of Financial Products and Services such as:

Bank Accounts

Debit Cards

Online Banking

Mobile Payments

Student Loans

Mortgages

Savings

Investments

Pensions

Robo Advisors

Brokers

…More

Videos

Business

InWork teaches Business Skills and information about topics such as:

Business Plan

Minimum Viable Product

Competitors

Risk

Operating Costs

Cashflow

Profit & Loss

Distribution Channels

Digital Marketing

Investment Capital

Shareholders

…More